Driven to Create Value

Pillarstone Capital (OTC Pink: PRLE) is a real estate opportunity company focused on creating shareholder value through acquiring, developing and redeveloping commercial real estate properties. Pillarstone has been a publicly traded company with a stable management team extracting significant value from real estate assets since 1994.

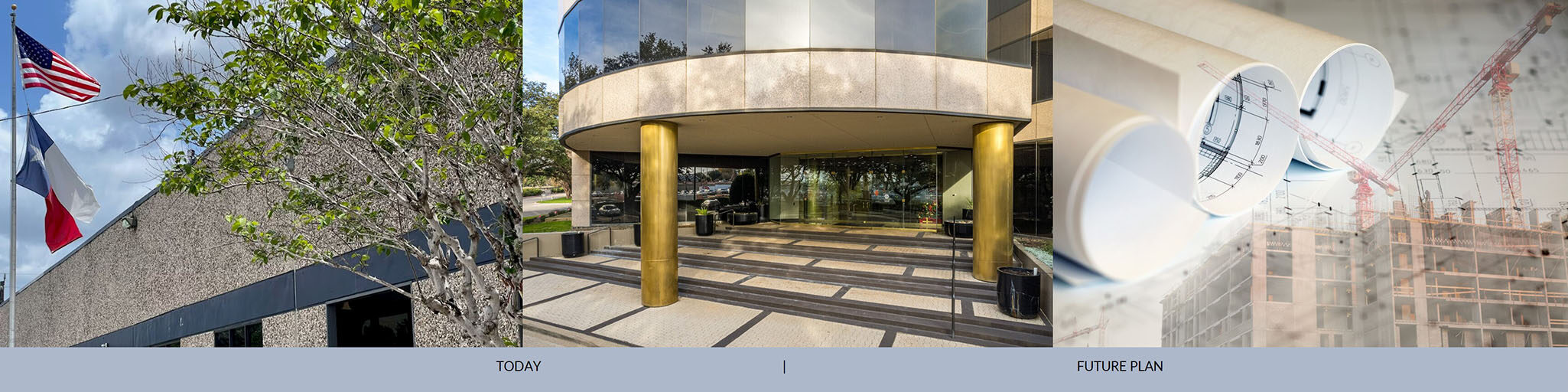

In 2022, Pillarstone activated phase 2 of its long-term business plan to position the company for growth. It internalized management and expanded its leadership team to include additional seasoned commercial real estate executives with expertise in capital markets, growing companies and redeveloping commercial real estate portfolios.

Pillarstone Capital REIT’s value-add portfolio consists of high-density urban mid-rise office buildings and suburban office/flex properties located close to major highway arteries. The company currently owns eight properties in Houston and Dallas.

— • —

Investment Strategy

To create higher yield value and achieve above-average returns, Pillarstone targets specific opportunities, asset classes and properties. Pillarstone achieves its growth-oriented ownership potential through recapitalizations, value-add acquisitions, strategic alliance joint ventures, specialized private equity, and more efficient capital stacks and investments.

Recapitalizations and

Special Situations

Pillarstone seeks investment opportunities that will benefit from recapitalizations and other situational investments, such as funding capital expenditures and capital infusion in undercapitalized situations, as well as acquiring and re-zoning land for development.

Investment Objectives

Providing above-average risk-adjusted returns; pursuing value-add strategies for shareholders while helping strategic partners achieve their financial goals throughout various marketplace cycles; establishing ownership positions in underperforming real estate, well-located multi- and single-tenant properties, and related businesses and franchises; and capturing enhanced value for investors through the acquisition and development of underappreciated or challenged real estate.

Pillarstone Capital REIT | Specialties

Direct Investments | Secondary Investment | Co-Investments

Mezzanine Investments | Monitoring | Reporting

281-747-9997

281-747-9997  19407 Park Row, Suite 140

19407 Park Row, Suite 140  Houston, TX 77084

Houston, TX 77084  Trading Symbol: OTC Pink: PRLE

Trading Symbol: OTC Pink: PRLE